Weekly Snack #9

New Equity Idea Generation, Twitter Posts, and General Reasearch of the Week

Welcome to Weekly Snacks! This newsletter is home to a weekly compilation of new investment ideas, Twitter posts/threads, and general research to help all investors generate ideas that they may have otherwise not been exposed to.

If you find our posts helpful, please click the subscribe button below (it’s free), and if you yourself have an idea you’d like to share with us to possibly be featured, comment below.

Investment Pitches

TL;DR:

“After conducting a forensic financial review of e.l.f. Beauty (ELF), one of the most richly valued stocks in the cosmetics and beauty industry, Spruce Point questions why e.l.f. partnered With Movers+Shakers, an advertising agency co-founded by former members of the NXIVM cult. We find evidence that suggests Movers+Shakers has messaging, branding and continued connections to the teachings of imprisoned cult leader Keith Raniere and his loyalists. The report reveals evidence that e.l.f. has used marketing messages that appear similar to those frequently used within the cult and urges retail partners including Target, Walmart and Ulta Beauty to reevaluate their connections with e.l.f. Based on our investigation, we estimate a 45% to 65% downside risk, or $34.35-$54.00 per share.”

TL;DR:

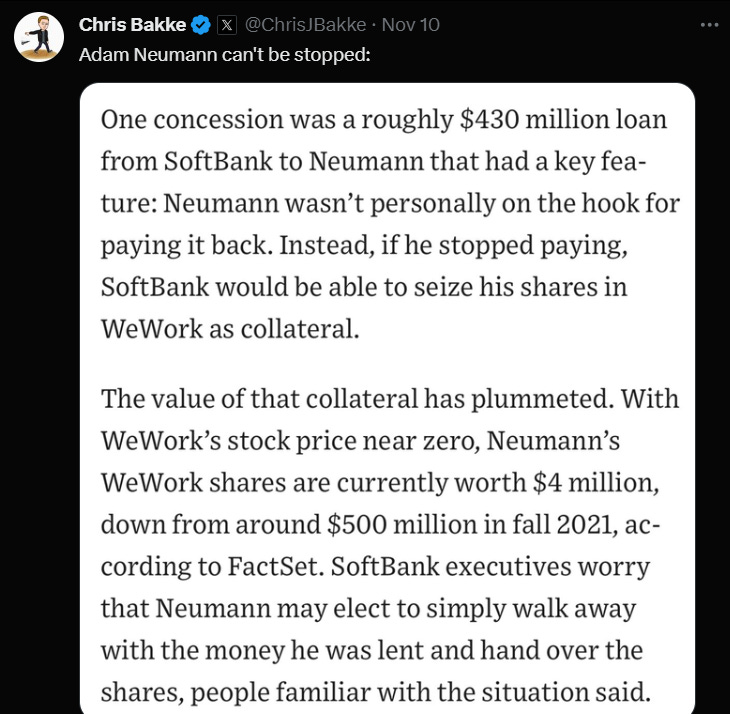

While not so much a trade, I enjoy reading PETITION ‘s newsletter. This week, he talked about the WeWork (WEWKQ) bankruptcy. He goes in-depth about the debt structure, timeline of events, and other interesting takes from Adam Neuman. It’s a good read and see if you think there could be a play out of it. Personally I think the equity is zero but if you’re high-risk, maybe it’s worth something to you.

TL;DR:

I came across Voss Capital’s post on Cement and Roadstone Holdings (CRH), which is one of the largest aggregates and infrastructure companies in the US and Europe. This is an interesting idea because it’s a company in a market that has zero sex appeal, is incredibly boring, and best of all, overlooked. With diversification through services and geo, Voss believes that there’s limited downside risk and makes it for an attrative long. Based on the authors math, they believe that on 2025 estimates, the valuation is closer to $120/share which equates to roughly a 118% upside to the current share price.

TL;DR:

While not necessarily an investor pitch, I found it interesting that Astra Space (ASTR) was entertaining a management buyout of $30 million at a $1.50/share takeover. This is after going public via SPAC at a $2.1 billion valuation. The stock is currently trading at $1.35 but if you are bullish that the company will agree to be sold, then you still have about an 11% spread here to the upside or if you choose to, see about grabbing some shares to short post-pop.

TL;DR:

StockOpine’s recent article on pool is a not so long read and breaks down what the company has been doing in a not so long way. It’s a company I’ve looked at in the past but decided to ultimately skip on due to my fear around new builds despite the stickiness of thier recurring revenue base. The author breaks down their math behind growth potential and seems like in the immediate term, everything is priced in for the upside. However, you might think differently after reading.

Tweets of the Week

General Research

Appreciate you taking the time to read Weekly Snacks. I hope you have found at least some of these links to be interesting enough to dive into yourself.

If you haven’t already, consider hitting the subscribe button below and sharing this Substack with someone you know.

Until next week,

Paul Cerro

Excellent snacks this week! Added 2 more substacks to subscribe to.

Thank you so much for sharing our POOL article.