Weekly Snack #8

New Equity Idea Generation, Twitter Posts, and General Reasearch of the Week

Welcome to Weekly Snacks! This newsletter is home to a weekly compilation of new investment ideas, Twitter posts/threads, and general research to help all investors generate ideas that they may have otherwise not been exposed to.

If you find our posts helpful, please click the subscribe button below (it’s free), and if you yourself have an idea you’d like to share with us to possibly be featured, comment below.

Investment Pitches

TL;DR:

Under-Followed-Stocks posted their thoughts not long ago on a name that I’ve seen come up quite a few times recently on Twitter called Lindbergh SpA (LDB.MI). The company provides maintenance and repair solutions across Italy and most recently, in France through an acquisition. The company is illiquid (6 million share float), has a high insider ownership (67%), and is a misunderstood stock. The author believes that the acquisition of its French subsidiary that wasn’t profitable will find a turnaround and help propel the company’s margins back on the right track. With 39% EBIT margins, if you believe that a turnaround can happen, perhaps now is a good time to check this one out.

TL;DR:

Value Don't Lie posted quick thoughts on John Wiley & Sons (WLY) for a turnaround play. To be clear, these are very quick thoughts but still enough to potentially dive deeper if you think the value is there. WLY offers publishing, academic and research journal services and has been plagued by bad capital allocation. The CEO got canned, the interim CEO is selling shares, and the stock has been annihilated this year. The author believes that much of the bad news has already been priced in and the company is historically in a very stable business despite sales growth concerns and an already hefty impairment to assets. Given that PE is looking into the space, a turnaround could either come from the company righting the ship or potentially being sold to a better operator than existing management.

TL;DR:

Librarian Capital's Research Library posted their thoughts on Estee Lauder (EL) and its recent terrible earnings report. EL was once a darling blue chip stock and having stood near/at the top of premium makeup/skincare, it was hard to believe how much it’s stuggled over the last 18 months. In their post, the author does an excellent job breaking down the earnings, the troubles that have been occuring and their opinion on valuation and growth over the long term. They believe that through 2026, with the appropriate exectution in place, that EL can deliver a 48% return by summer of 2026. If you’re a fan of an author that breaks the math down, have a look here.

TL;DR:

I’ve posted Special Situation Investing’s posts in the past and enjoy reading them. This one is interesting because it’s a “coal” company that owns the surface and mineral rights to approximately 50,000 acres within a 10-mile radius of Beckley, West Virginia. We’re talking about Beaver Coal Ltd (BVERS) which is a limited partnership on the OTC market and is illiquid. It’s neat because all of BVERS revenue (aside from land sales) comes from rent-based or royalty based sources. The author highlights this as a great model because you have a company that is capital light with little to no capex and minimal opex. Historically, the company has outpaced the SPY since 2010 but that doesn’t mean it will continue that way. The stock performance seems to suggest it’s tied to how well the dividend is and if that goes, so too might the stock. A great read and written very well. It also comes with audio incase anyone would rather listen.

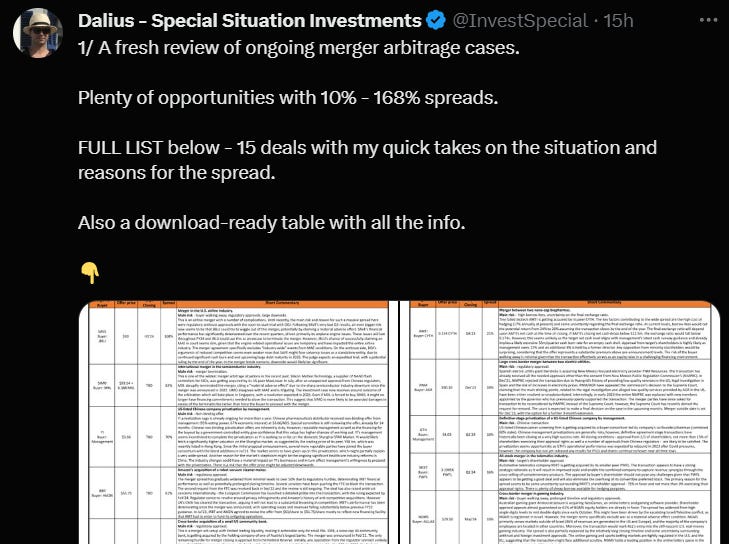

Tweets of the Week

General Research

Appreciate you taking the time to read Weekly Snacks. I hope you have found at least some of these links to be interesting enough to dive into yourself.

If you haven’t already, consider hitting the subscribe button below and sharing this Substack with someone you know.

Until next week,

Paul Cerro

Thank you for highlighting my EL article.