Weekly Snack #4

New Equity Idea Generation, Twitter Posts, and General Reasearch of the Week

Welcome to Weekly Snacks! This newsletter is home to a weekly compilation of new investment ideas, Twitter posts/threads, and general research to help all investors generate ideas that they may have otherwise not been exposed to.

If you find our posts helpful, please click the subscribe button below (it’s free), and if you yourself have an idea you’d like to share with us to possibly be featured, comment below.

Investment Pitches

TL;DR:

Clark Street Value brought up an interesting biotech that’s currently trading under NAV. The author breaks down a few key aspects that make the company appear better than what the market is giving it. Given the current share price and presumed NAV, the stock could potentially have a double-digit upside.

TL;DR:

The author believes that Build-A-Bear Workshop (BBW) is a great buy. The author highlights the company broadly but also goes into how BBW has done will with generating FCF, expanding margins, and redistributing capital. They provide a detailed projection of the company financials where they estimate that shares could be worth nearly double what they are today.

TL;DR:

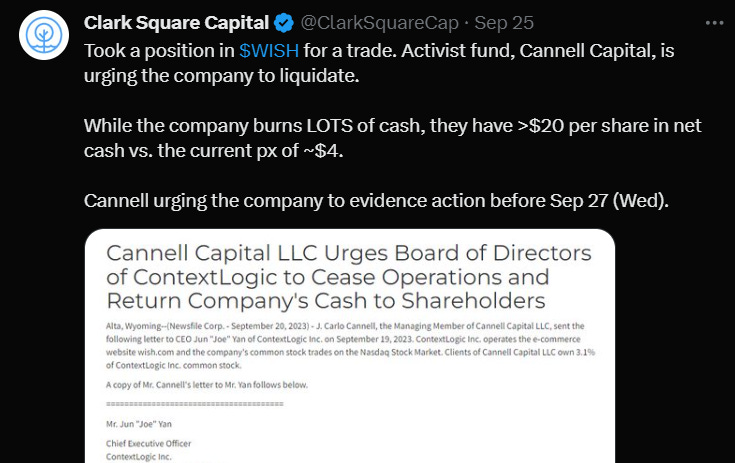

Clark is a great investor and I’ve enjoyed his pitches over the last year. He recently came about an event driven trade brought on by activist Cannell Capital who is urging managment to just shutdown and return cash to investors. The upside for investors could be multiples higher but that’s only if management is willing to admit defeat. Take a look at his very short Twitter thread to analyze the trade.

TL;DR:

The author is recommending Evloution Gaming (EVVTY) and goes into detail on the business and what makes it special. Fundasy believes that the way that management has executed on capital allocation and done to boost margins can potentially lead the stock to generate double-digit returns over the next decade.

Tweets of the Week

General Research

Appreciate you taking the time to read Weekly Snacks. I hope you have found at least some of these links to be interesting enough to dive into yourself.

If you haven’t already, consider hitting the subscribe button below and sharing this Substack with someone you know.

Until next week,

Paul Cerro