Weekly Snack #37

New Investment Pitches, General Research, and Tweets of the Week

Welcome to Weekly Snacks! This newsletter is home to a weekly compilation of new investment ideas, Twitter posts/threads, general research, and podcasts to help all investors generate ideas that they may have otherwise not been exposed to.

If you find our posts helpful, please click the subscribe button below (it’s free), and if you have an idea you’d like to share with us to possibly be featured, comment below.

Investment Pitches

TL;DR:

With so much surrounding the GLP-1 hype over the last year, Hims and Her Health (HIMS) has been very much in the public eye. I took to writing a post-earnings update on why I believe the stock has slumped since earnings. I also raised concerns about the future strategy around the compounding of GLP-1s which does nothing but add uncertainty and risk to what was originally a pretty straightforward strategy.

TL;DR:

I know I posted another idea from Jake last week but he had another one from his investor letter that I needed to share with you all. It’s on Wise Plc (WISE), a facilitator cross-border money transfers for personal and business customers across more than 160 countries and more than 40 different currencies. Jake believes that the long story for this company is quite compelling and the underlying business is not getting the recognition it deserves. I would take a read at this one and see for yourself.

TL;DR:

Coming from another short seller, Bleecker Street, they now believe that Gogo Inc (GOGO) is really pushing their promises of a 5G upgrade. Bleecker highlights that the outsourced development of this upgrade has been riddled with delays leaving the company with a stagnant business for several years now. They hint that the company is not being entirely truthful in its disclosures to investors about the problems that it’s having. With Elon’s Starlink coming online, the competetion is real for the future of GOGO.

TL;DR:

Spruce Point recently wrote a short report on Zebra Technologies Corp (ZBRA), a designer and manufacturer of bar code scanners, printers, and mobile computing devices. They believe that their $2.1 billion leveraged acquisition spree and venture investments should be considered failures. They also raise concerns about multiple accounting and financial reporting which leads them to believe a downside of 65% - 80% in the stock price may be warranted.

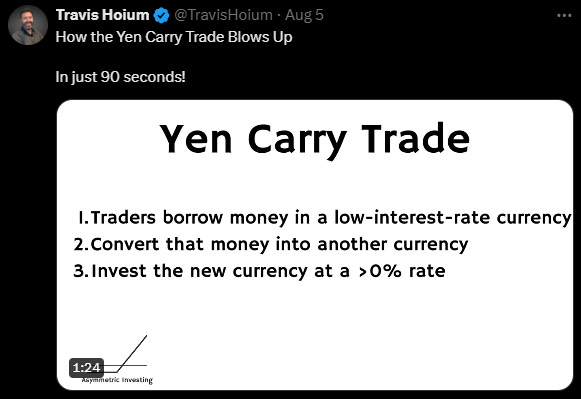

Tweets of the Week

General Research

Podcasts

Appreciate you taking the time to read Weekly Snacks. I hope you have found at least some of these links to be interesting enough to dive into yourself.

If you haven’t already, consider hitting the subscribe button below and sharing this Substack with someone you know.

Until next week,

Paul Cerro