Weekly Snack #29

Toe nail fungus treatment, P2P shipping in Asia and good ole fashion American Pizza

Welcome to Weekly Snacks! This newsletter is home to a weekly compilation of new investment ideas, Twitter posts/threads, general research, and podcasts to help all investors generate ideas that they may have otherwise not been exposed to.

If you find our posts helpful, please click the subscribe button below (it’s free), and if you have an idea you’d like to share with us to possibly be featured, comment below.

Investment Pitches

TL;DR:

Coming off the recently hot presses of toe nail fungus, Framp Files published their quick thoughts on Moberg Pharma (MOB.ST), the maker of the toe nail fungus that Cipher Pharmaceuticals has licenesed from them. MOB-015 (Terclara) if the treatment being hailed as a far superior treatment for toe nail fungs against other treatments like Jublia, Polichem P0358, NP-2313 Novoexatin and others. This opportunity has gained a lot of fanfare because the market opportunity for the treatment is estimated to be between $250 - $500 million which is anywhere from 2.5x - 5x the current market cap. With a better drug and a potentially underestimated market size, it’s no wonder why this drug and company have gotten so much attention.

TL;DR:

An interesting post from Sweet Stocks on SITC International Holdings (1308:HKG), an intra-Asia container vessel specialistfocusing on point-to-point routes with high frequency. It was interesting to me because I don’t know jack shit about shipping and Alex wrote a great explanation on the business well enough for anyone to understand. As many of you probably already know, shipping largely benefitted from supply chain issues during COVID and have been coming down hard since they all peaked.

Alex believes that the company is returning to normalization and with that, historically high ROICs (avg 20.8%), positive FCF, and capital allocation when it comes to buying vessels. Factoring in continued decline in 2024 to reach full normalization, Alex thinks waiting for a bottom before investing doesn’t make sense and that now might be a good time to start looking at this company over the next 3 - 5 years.

TL;DR:

This recent note on Domino’s Pizza (DPZ) is shared by me. I originally wrote about my thoughts on DPZ back in April 2022 and thought the 2-year potential was there despite the high inflation and labor issues. My model proved pretty close to how the price unfolded on the downside and upside but relooking at the company post their most recent earnings and 42% run-up over the last 1.25 years, I didn’t think it was worth holding anymore.

In my analysis, I breakdown how unit growth tied to sales growth — which trickles down the PnL to benefit margins — wouldn’t be able to meet managements targets and thus, command a higher share price. LT it might be a different story but over the next 1-2 years, I just don’t see it. Have a look at my model and let me know your thoughts if you have any.

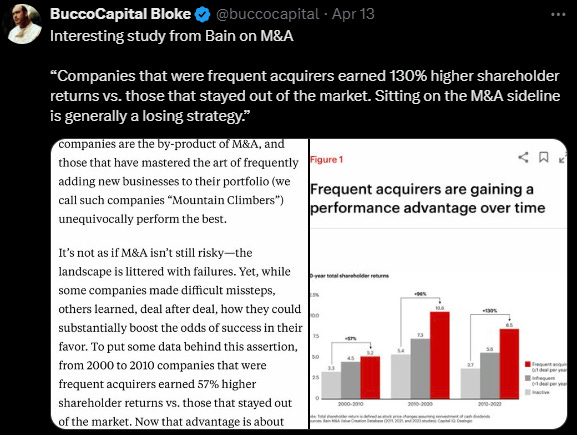

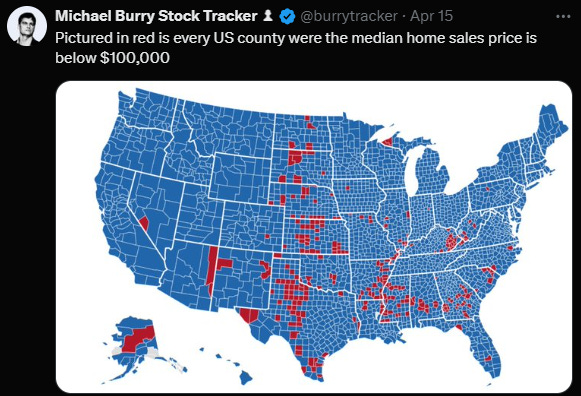

Tweets of the Week

General Research

Podcasts & Interviews

Appreciate you taking the time to read Weekly Snacks. I hope you have found at least some of these links to be interesting enough to dive into yourself.

If you haven’t already, consider hitting the subscribe button below and sharing this Substack with someone you know.

Until next week,

Paul Cerro

👌🦉