Weekly Snack #24

Royalty plays, and 2 re-ratings in the CPG space that warrants your attention

Welcome to Weekly Snacks! This newsletter is home to a weekly compilation of new investment ideas, Twitter posts/threads, general research, and podcasts to help all investors generate ideas that they may have otherwise not been exposed to.

If you find our posts helpful, please click the subscribe button below (it’s free), and if you yourself have an idea you’d like to share with us to possibly be featured, comment below.

Additionally, I also launched a new Substack that’s exclusively on the cannabis industry. I covered it widely in 2021 and parts of 2022 but didn’t want to incorporate that into my core notebook for people who don’t want that type of research.

If you’re interested, just click the button below. It’s also free!

Investment Pitches

TL;DR:

Special Situation Investing by Six Bravo wrote a piece on PrairieSky Royalty (PREKF), who leases mineral rights to dozens of Canada’s top oil producers, both public and private. The play here is the completion of Trans Mountain Pipeline Expansion which was set to increase oil barrels per day from 300k to 890k. Because of the royalty nature of PrarieSky’s business, when its customers produce and ship more product, and and if the Canadian crude discount decreases, PrairieSky’s royalty revenue will increase as a result. Because of its asset-light business model, this increase will almost entirely fall to its bottom line to the benefit of its shareholders. I won’t spoil the rest but it’s definitely worth a read.

TL;DR:

Siyu LI recently shared his thoughts on Dole DOLE 0.00%↑, the company that sells a lot of fruits and vegetables. Siyu believes that there is a valuation gap between DOLE and its peers despite to pending sales currently going on. Given the current EV/EBITDA that DOLE is trading for, the pending asset sales are valuing each significantly higher than the parent company. With normalized EBITDA and a continuation of de-leveraging, it makes for an interesting case for a multiple re-rating, especially after it’s IPO back in 2021. The debate is whether the market agrees.

TL;DR:

Dave Waters shared his thoughts on a Mexican blue chip called Grupo Herdez (GUZOF), a major Mexican food company. They own a vested interest in a lot of the brands that likely you and I both buy on a regular basis. Like Siyu’s pitch above, Grupo Herdez actually trades at a lot less of a multiple than its peers (McCormick, Kraft Heinz, and Hormel). Given the more attractive growth rates, Dave thinks that the company is trading too cheaply and if re-rated, would command a near 55% higher share price. See why he thinks it makes for a compelling investment.

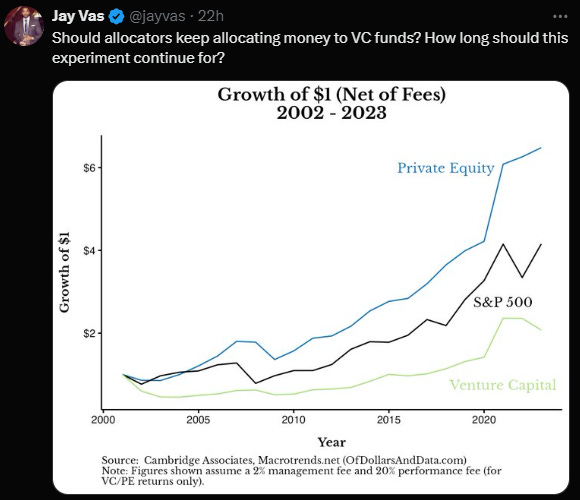

Tweets of the Week

General Research

Podcasts & Interviews

Appreciate you taking the time to read Weekly Snacks. I hope you have found at least some of these links to be interesting enough to dive into yourself.

If you haven’t already, consider hitting the subscribe button below and sharing this Substack with someone you know.

Until next week,

Paul Cerro