Weekly Snack #19

Mental health providers, a slow growth consulting business, an overpriced IPO and lastly, an arts and antiques business

Welcome to Weekly Snacks! This newsletter is home to a weekly compilation of new investment ideas, Twitter posts/threads, general research, and podcasts to help all investors generate ideas that they may have otherwise not been exposed to.

If you find our posts helpful, please click the subscribe button below (it’s free), and if you yourself have an idea you’d like to share with us to possibly be featured, comment below.

Investment Pitches

TL;DR:

Loved this pitch from Hindenburg Research on the mental health provider, LifeStance LFST 0.00%↑. Hindenburg highlights growing problems at the company with high clinician turnover, rapidly dwindling cash balance, questionable medication prescriptions to patients that may or may not need it, 2 class action lawsuits and insiders dumping shares. Great read for anyone looking to get some short ideas.

TL;DR:

Conor Mac from Investment Talk published a piece on Auction Technology Group (LON: ATG), a digital marketplace business that publishes the Antiques Trade Gazette. Conor thinks that while the company’s high market share isn’t necessarily a “moat”, but rather its ability to generate a strong network effect to the arts and antique community. With low growth but stable cash flows, the business of ATG could be an interesting play if you believe that the company isn’t benefitting from cyclical changes.

TL;DR:

I published my thoughts on the Amer Sports AS 0.00%↑ IPO that happened this week. The sports apparel manufacturer was supposed to go public between $16 - $18/share and I said that it was not worth that price. The recent growth that the company was able to accomplish was impressive but it was mainly coming from one area: China. Because of the risks involved and how rich the valuation would have been, I stayed away from this IPO. The stock priced at $13/share and opened at $13.40

TL;DR:

Ironside Research published his thoughts on Franklin Covey FC 0.00%↑, a company that specializes in training and coaching consulting services to enterprises. Ironside believes that the way that company generates its revenue is “high quality” because instead of paying a monthly service, the company gets paid up front and in cash for the projects it works on. The company also has a strong capital allocation strategy that has retired ~20% of the shares outstanding over the last 10 years. With overall growth decelerating, Ironside beleives that the times of easy comps has passed but thinks 2-year IRR could be upwards of 30%.

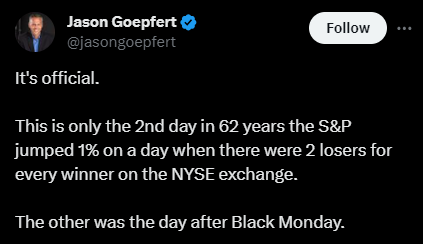

Tweets of the Week

General Research

Podcasts & Interviews

Appreciate you taking the time to read Weekly Snacks. I hope you have found at least some of these links to be interesting enough to dive into yourself.

If you haven’t already, consider hitting the subscribe button below and sharing this Substack with someone you know.

Until next week,

Paul Cerro