Weekly Snack #13

New Equity Idea Generation, Twitter Posts, and General Reasearch of the Week

Welcome to Weekly Snacks! This newsletter is home to a weekly compilation of new investment ideas, Twitter posts/threads, general research, and podcasts to help all investors generate ideas that they may have otherwise not been exposed to.

If you find our posts helpful, please click the subscribe button below (it’s free), and if you yourself have an idea you’d like to share with us to possibly be featured, comment below.

Investment Pitches

TL;DR:

Valorem Research - Legal Special Situations posted about the ongoing Jetblue JBLU 0.00%↑ and Spirit Airways SAVE 0.00%↑ merger. I really liked reading this post because he goes over the basics of the deal, the issues, and key points in a very easy to read post. While this one is on the shorter side, he did post updated thoughts on the recently sumbitted briefs but it is behind a paywall as an FYI.

TL;DR:

Unlike the brief thoughts shared above, Siyu LI gave an update on the Jetblue / Spirit merger and his thoughts on the possibility/liklihood of it closing. He shares his thoughts post trial closing to bring the arb trader up to speed. The three biggest hurdles he talks about are the DoT Transfer Certificate, Material Adverse Effect (MAE), and Financing. Good thing for anyone that wants it, he shows his math as well.

TL;DR:

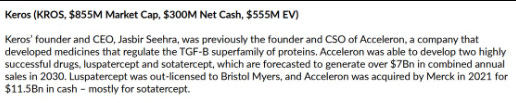

This one is a Twitter post but it’s of equity research so I decided to include it up here. @Biohazard3737 shared his thoughts on Keros Therapeutics KROS 0.00%↑, a biopharma company that specializes in novel treatments for patients suffering from hematological, pulmonary, and cardiovascular disorders. While the stock recently got hit from their KER-50 trial, @Biohazard3737 believes that the company is still a compelling long and shared his write-up in the link above.

TL;DR:

Bleeker Street Research posted thier thoughts on NextNav NN 0.00%↑, a company that was trying to build a better GPS over the last 16 years. After raising almost close to 3/4 of a billion dollars over its life, it hasn’t acheived much. Bleeker believes that it recent debt raise at high interest rates, at nearly double their revenue, will not allow the company to continue its quest to go up against the likes of Google and Apple. They believe that this is a company that should just never have gone public via SPAC.

TL;DR:

Daikoku Capital and Nithin Mantena wrote an in-depth write-up on American Coastal Insurance Corporation ACIC 0.00%↑. They’re exclusively focused on garden-style condominiums that have above-average risk characteristics and sell windstorm insurance policies to the HOAs that represent them. Both authors believe that the high quality nature of the company reinforces their conviction in the company. They break down hurricane risk, reinsurance, managment, equity offering, and NY personal lines of exposure. And just like any good right up, they include thier math with what they beleive to be a 200% upside.

Tweets of the Week

General Research

Podcasts & Interviews

Appreciate you taking the time to read Weekly Snacks. I hope you have found at least some of these links to be interesting enough to dive into yourself.

If you haven’t already, consider hitting the subscribe button below and sharing this Substack with someone you know.

Until next week,

Paul Cerro