Weekly Snack #1

New Equity Idea Generation, Twitter Posts, and General Reasearch of the Week

Welcome to Weekly Snacks! This newsletter is home to a weekly compilation of new investment ideas, Twitter posts/threads, and general research to help all investors generate ideas that they may have otherwise not been exposed to.

If you find our posts helpful, please click the subscribe button below (it’s free), and if you yourself have an idea you’d like to share with us to possibly be featured, comment below.

Investment Pitches

TL;DR:

Spire is too cheap at 1.2x 2023e revenue. It benefits from (1) a 4-5 year first mover advantage, (2) high barriers to entry, (3) an irreplicable data archive, and (4) an end-to-end (customer-to-space system design) feedback loop. It expects to reach positive free cash flow in Q1-Q3 2024, at which point the market is likely to reassess the value of the business. A 100%+ return by year-end 2024 is reasonable, but expect outsized volatility along the way.

TL;DR:

The author argues that the Shark Ninja is an interesting spin because you have a company with a ~15 year long track record of >20% growth that dominates (and maintains domination) just about every category they launch into that currently trades for a low double digit multiple. It’s probably even cheaper than it looks if you really backed out all of their growth investments, and the management team who orchestrated all of that growth is going to be insanely incentivized to quickly gain coverage and drive the stock higher (or just increase value in the long run if you’re into that thing) given massive (and possibly underreported) stock ownership.

TL;DR:

The author argues that the Nasdaq is an interesting business due to it’s size, market dominance and stickiness of revenues. Should management be able to execute well on growth expectations, improve terminal EBITDA margins through high margin upselling (which is not unrealistic), the stock can be poised for double-digit returns over the next few years. There is a multiple expansion component though not egregious given where the stock has traded over the last three years.

TL;DR:

The author highlights Alpha Metallurgical Resources as an “uber cannibal”. A company that spends so much of its cash on buying back shares that it “cannibalizes” itself. Offering two scenarios for buybacks going forward, the company can continue buying back shares at just under 10% a year. These are not unrealistic scenarios considering that AMR has routinely increased its share buyback authorization over the last 2 years. The author breaks down how they’re playing the this overall trade at the end of the pitch.

TL;DR:

The author argues that the upside for Nathan’s Famous is quite attractive. The company has been able to grow EPS with minimal capital invested while keeping the overall business very capital light. Managements capital allocation strategy has emphasized de-leveraging and reducing operational expenses which could mean additional value to shareholders in the form of higher dividends. Lastly, the licensing agreement with Smithfield could extend beyond 2032 to ensure durable licensing cashflow.

TL;DR:

Peloton has proven that there is a market for connected fitness, however, the company continues to struggle with cash flow and jumpstarting growth. While cash burn has been more or less tamed, the author suggests that Peloton cannot continue as a standalone company and needs to be acquired in order to benefit from the resources and balance sheet of a strategic.

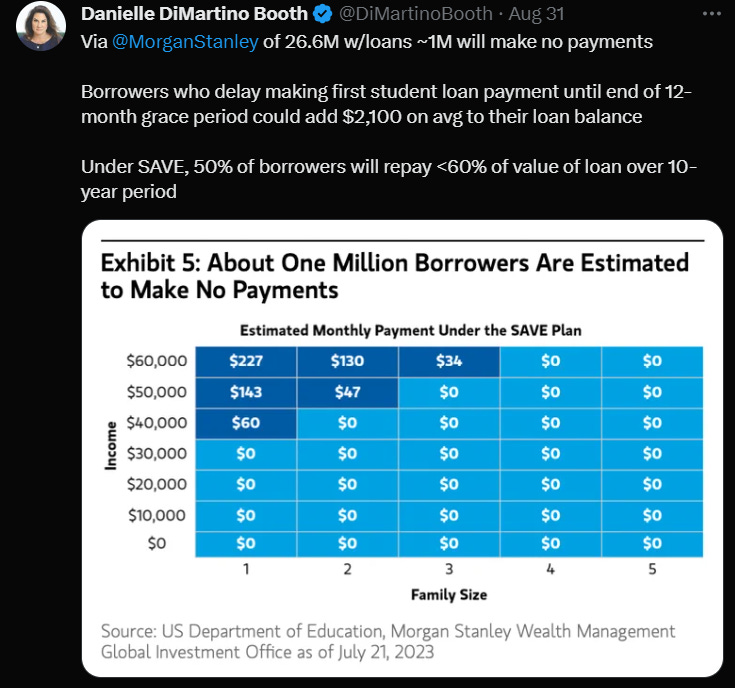

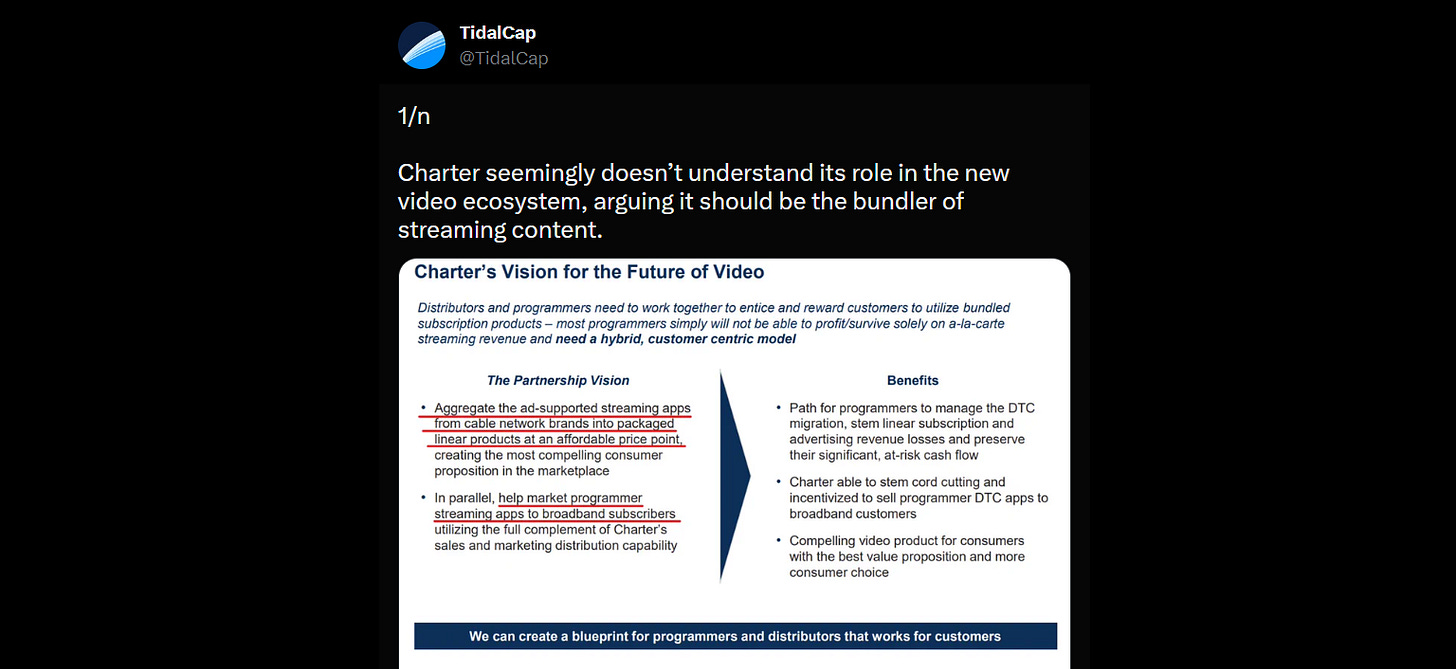

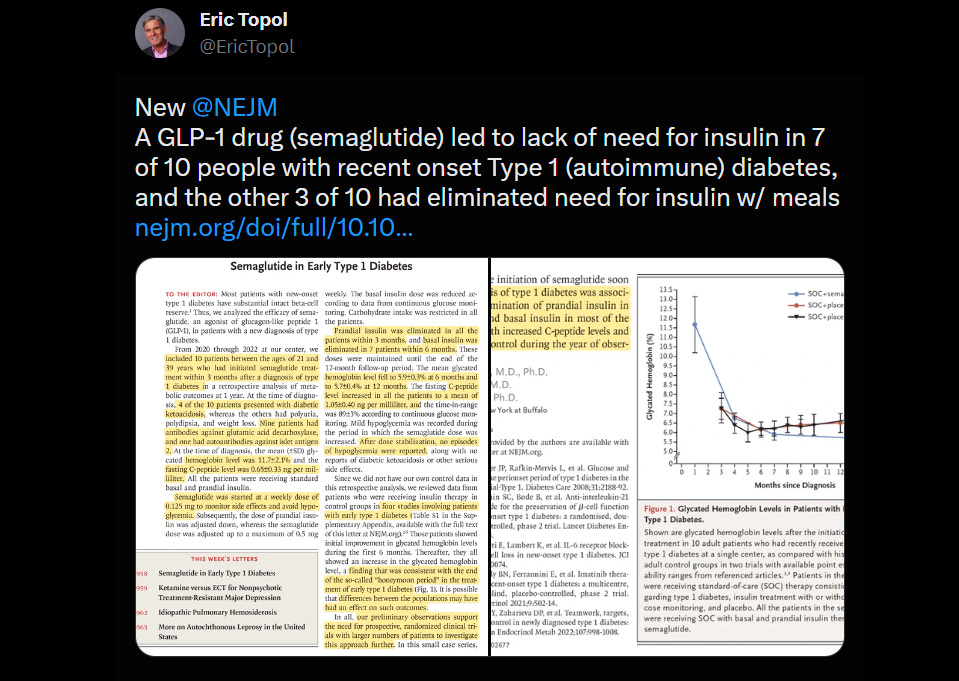

Tweets of the Week

General Research

Dividends and their Misconception - Meb Faber

The original Tweet here outlines Meb’s commentary on dividend investors and their hill of “passive income”.

Appreciate you taking the time to read Weekly Snacks. I hope you have found at least some of these links to be interesting enough to dive into yourself.

If you haven’t already, consider hitting the subscribe button below and sharing this Substack with someone you know.

Until next week,

Paul Cerro

Thanks for sharing our piece on a dirty coal company...Alpha Metallurgical Resources.

We really enjoy this format that gives the TL;DR to the reader before he/she opts to read it. Great job!

Thank you for mentioning our Nasdaq article.